The Caldwell County school board approved the tax rates for 2022-2023 at Monday night’s meeting.

Superintendent Dr. Jeremy Roach explained that unless the district is taking an increase above 4% they do not have to have a public hearing or do any advertising, which is different this year. He added after reviewing the tax rates last week the compensating rate will keep the tax rate the same at 44.6 cents per hundred dollars assessed value for real estate and personal property and the motor vehicle tax rate at 53.8 with the utilities tax remaining at 3%.

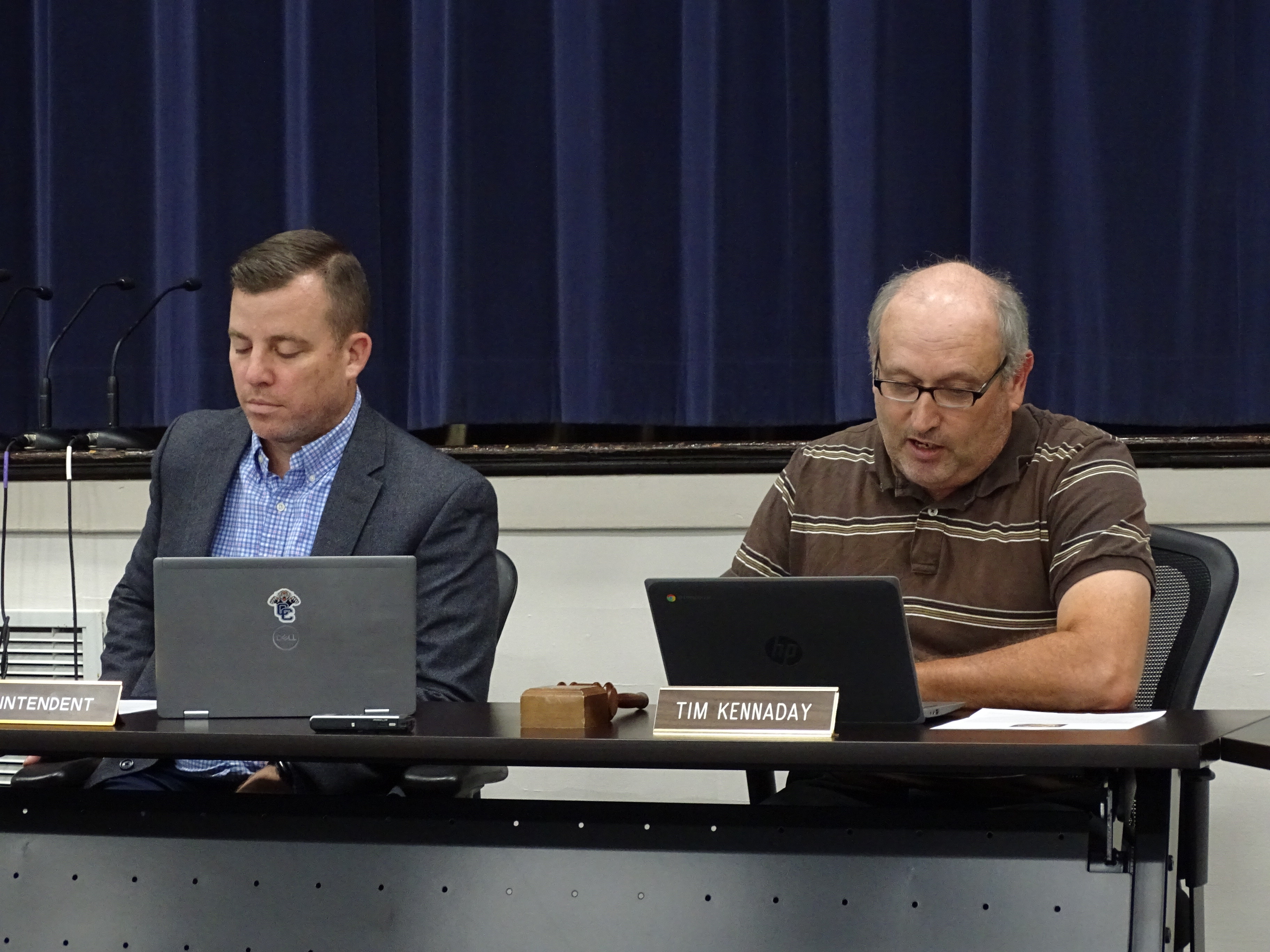

click to download audioBoard Chair Tim Kennaday asked Roach to explain the decreased value in the two areas on the tax report pertaining to the corporate tax and personal property which was affected by the December tornado.

click to download audioHe noted they will have to continue to look at it in depth going forward as homes and businesses are rebuilt, but Roach added he’s happy the tax rates were not affected this year by all the damage.

In other business, Dr. Roach said he has met with Princeton Mayor Kota Young and Princeton Police Chief Chris King to review the school resource officer contract and current staffing. He said they were all pleased with the current arrangement and contract. He noted they paid a little more last year but the contract is a similar setup as the last two years. He said this contract is for $50,000 for the police department to provide two SROs on campus in order to keep the district compliant with new legislation.

click to download audio

Roach was questioned by board member Anna Ray if one of the SROs would be at the high school and Roach explained the two SROs will rotate between all the schools.

click to download audioIn other action, board members approved a $1,000 increase in the middle school athletic director’s stipend. Roach explained the stipend would increase from $3,500 to $4,500 to cover additional sports responsibilities.