In the late hours of last Thursday, Kentucky’s House of Representatives overwhelmingly passed its heavily-argued House Bill 1 by a 79-to-19 count, which reduced the Commonwealth’s income tax from 5% to 4.5% — with hopes of eventually zeroing the fiscal funnel.

For many of the state’s Democrats, fears of fewer general funds could translate poorly in the coming decade — forcing amended budgets and services across the spectrum.

For many of the state’s Republicans, it’s a responsible, necessary and prudent move to compete with surrounding states for new residents, new businesses and new cash — as finances shift to higher sales taxes based on public consumption.

Eighth District Representative Walker Thomas, who voted in its favor, noted that behind Gov. Andy Beshear and the supermajority’s two-year economy, more than 47,500 jobs have been created in Kentucky. And the state either needs people to move here and take those jobs, or have some of the local workforce jump back into the pool.

Lower the state’s income tax, he said, is a “good way for people to keep more of their take-home pay,” and push it toward other goods and services.

Ninth District Representative Myron Dossett has been an advocate for such state measures since 2002, when he was first elected to the Christian County Fiscal Court.

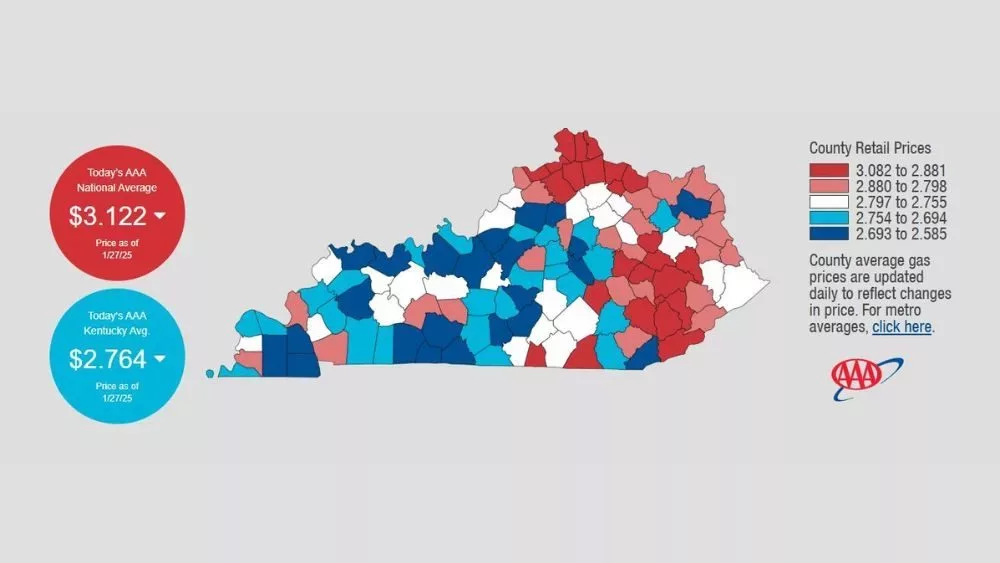

The desire in west Kentucky, and really all along the Kentucky-Tennessee state line, has been to have shoppers and prospective residents “turn left” into the Bluegrass, instead of “turning right” into the home of the Volunteers.

Dossett said he’s tried to explain to other metropolitan leaders across the state, and believes these graduated efforts are a correct step in the right direction.

Dossett added that if the population base increases, the consumption tax base increases for local and regional government — which would be a boon for education, municipalities and other implements.

And putting money back into people’s hands, Dossett said, gives people more choices.

Third District State Senator Whitney Westerfield will get to cast his vote near February 7, when House Bill 1 first enters that chamber before potentially moving to the governor’s desk.

He believes the bill will have little trouble rolling forward, but does want constituents to understand that certain budgetary benchmarks must be met before the tax falls to 4% in 2024, and even lower in the following years.

Furthermore, Westerfield said considerations must remain for the Commonwealth’s impoverished — as more take-home pay wouldn’t help with increased costs of goods, and particularly necessities.

Tennessee’s income tax is 1% to 2% on all income earned from interest and dividends. Illinois is at 4.95%. Indiana is at 3.23%. West Virginia’s ranges from 3% to 6.5%. Missouri’s covers from 1.5% to 5.4%. Virginia’s also ranges from 2% to 5.75%. Ohio’s spans from 2.85% to 4.8%.