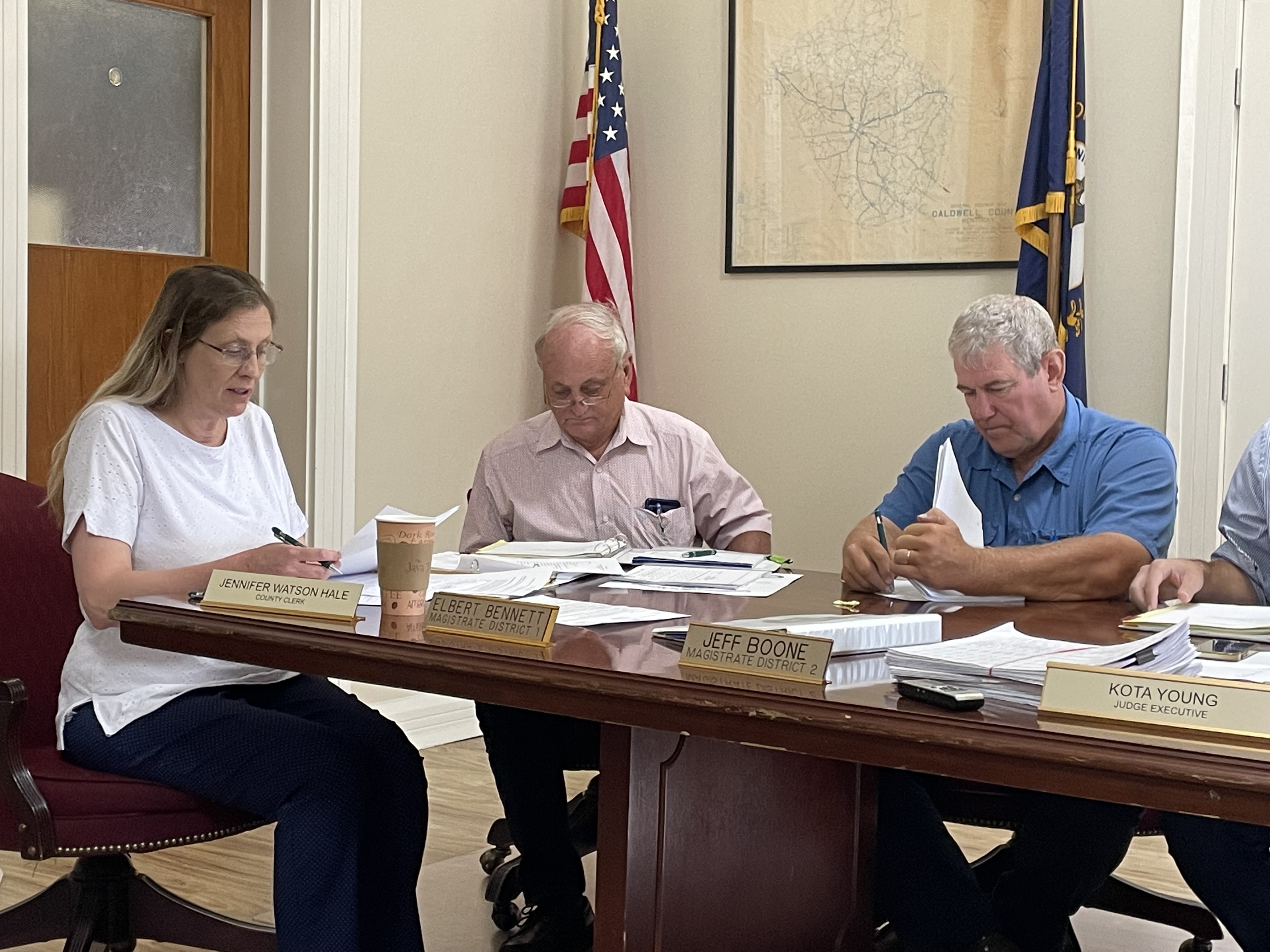

Caldwell County Fiscal Court approved the county tax rates on a second reading at a special called meeting Thursday morning.

Judge-Executive Kota Young presented the second reading of the ordinance setting the county’s property tax rate at 10 cents per $100 assessed value and the personal property tax rate at 10.73 cents per $100 assessed value.

click to download audioIn other new business, magistrates unanimously authorized Judge Young to apply for a cybersecurity grant.

click to download audioFurthermore, magistrates unanimously approved DY Inspections as the new state electrical inspector, along with the hiring of three road department employees, and heard a presentation from Linda Crenshaw about an upcoming virtual 5K ‘Shelter Shuffle’ to raise funds for the Caldwell County Animal Shelter.

During reports, Caldwell County Clerk Jennifer Watson-Hale announced that the cost of fishing and hunting licenses will slightly increase at the County Clerk’s Office after some changes were made by the Kentucky Department of Fish & Wildlife Resources.

click to download audioShe noted that the cost of the license will remain at $12 if they are purchased online.

Hale also mentioned there have been a couple of changes made to the redistricting map that will go into effect the day after the November general election. She added that the County Clerk’s Office will notify the residents who are affected by the redistricting.