Property tax bills were mailed out by the Caldwell County Sheriff’s Office in October and you have until the end of the month to pay the face amount before a penalty kicks in on January 1.

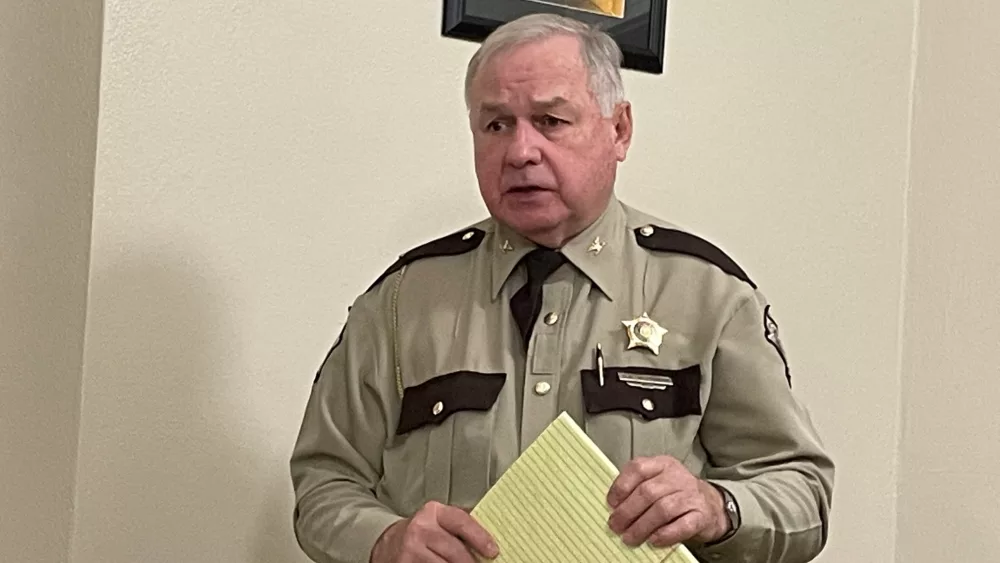

Sheriff Don Weedman says the property tax bill process begins in the PVA office.

click to download audioWeedman says there are some instances where a tax bill wasn’t sent out.

click to download audioMeanwhile, office manager Melissa Peek says some people did not get a bill even though one was sent.

click to download audioPeek also reminds you there are some groups of people eligible for a discount on the tax bill.

click to download audioPeek says payments can be made by cash or card in the sheriff’s office.

click to download audioShe says tax bill information can be obtained online but payments must be made in person.

Sheriff Weedman says the sheriff’s department has a new website to help answer questions about tax bills or other information.

click to download audioThe face amount of the tax bill is due by December 31, and Sheriff Weedman reminds you his office will be closed on Christmas Eve and Christmas Day as well as New Year’s Eve and New Year’s Day.

Property Tax Bills paid after January 1 will incur a 5% penalty until January 31. Tax bills paid after February 1 will see a 21% penalty added.