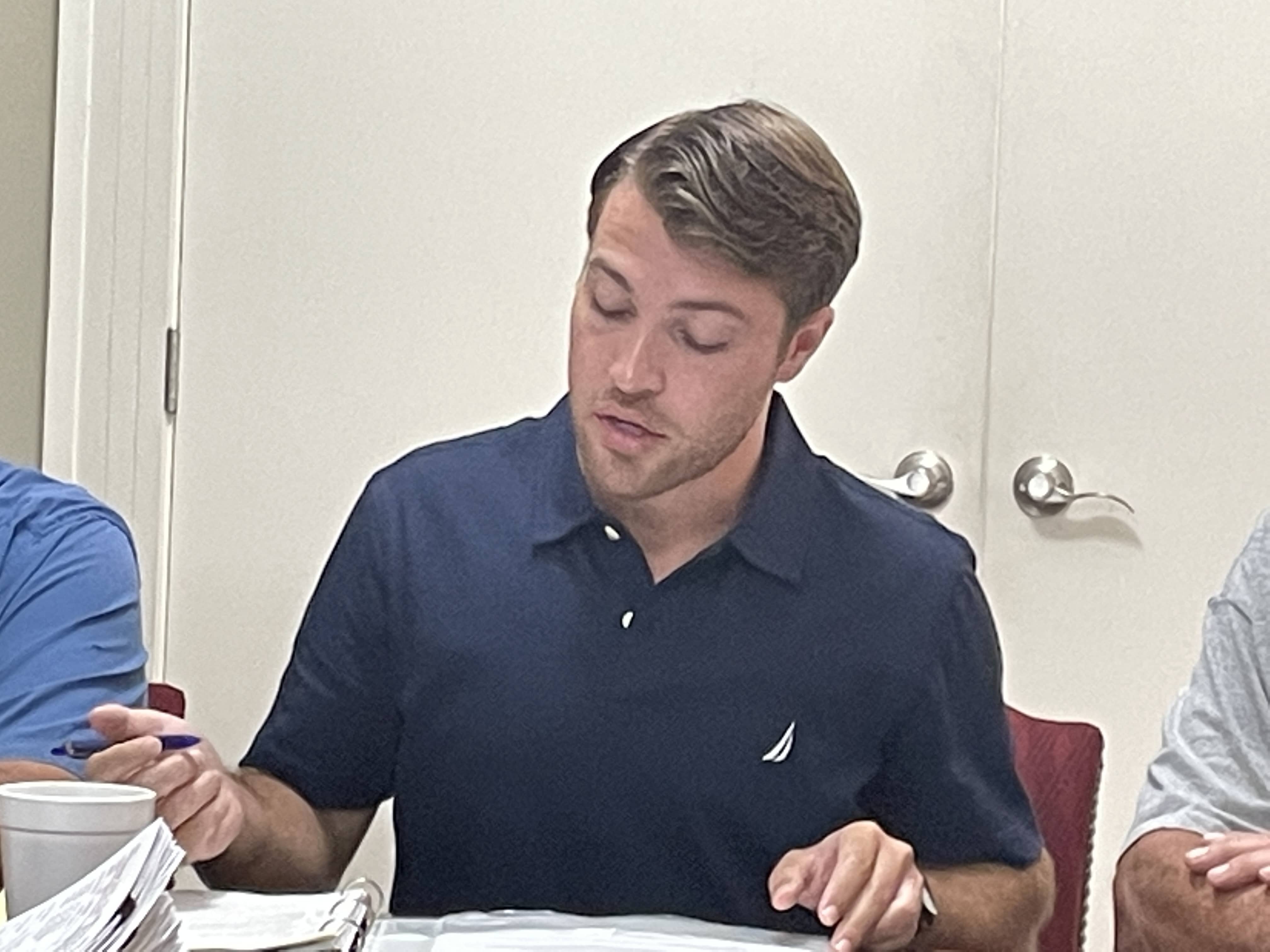

During Tuesday morning’s meeting, Caldwell County Fiscal Court approved the Calendar Year 2024 tax rates.

Judge-Executive Kota Young recommended maintaining the property tax rate at 10 cents per $100 of assessed value and adjusting the personal property tax rate to 10 cents per $100, slightly lower than last year’s rate of 10.7 cents.

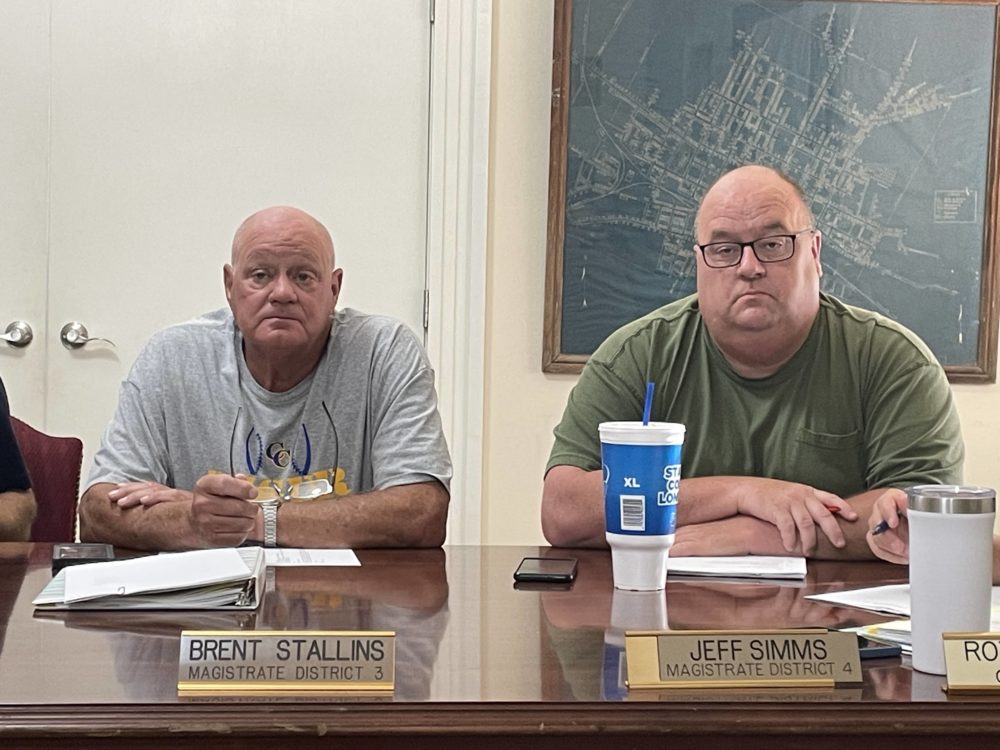

Given the current economic conditions, District 4 Magistrate Jeff Simms expressed his belief that now is an opportune time to offer some relief to residents.

click to download audioDistrict 2 Magistrate Jeff Boone noted that residents desire improved services and better roads but are reluctant to pay higher taxes. He emphasized that the funding for these improvements must come from somewhere.

Following their remarks, Judge Young presented the ordinance.

click to download audioThe proposed property tax rate and the personal tax rate were unanimously approved.

In other action, magistrates approved a bid of $1,105 from Stanley McKinney for the Caldwell County Animal Shelter van. Judge Young noted that this amount would go directly into the animal shelter’s account.

Magistrates also approved the Calendar Year 2023 Sheriff Property Tax Settlement, with Melissa Peek noting that they achieved a 96.4% collection rate this year.

Representatives from FEMA were also present at the meeting and reported that they have distributed $107,000 to residents who were affected by the the Memorial Day weekend tornado and severe storms. FEMA recently opened a Disaster Recovery Center at the Caldwell County Emergency Operations Center, located at Northfield Drive in Princeton, to assist individuals in applying for aid.

The Fiscal Court also was provided information from Adam Cruzen of the Jones-Keeney Wildlife Management Area which has remained closed to the public since the December 2021 tornado due to safety concerns after a berm was destroyed and what he is doing to try to get the shooting range reopened. Your WPKY News Edge will have more information about his efforts in the coming days.